Gifts of Appreciated Stock Can Be a “Win-Win” for You and Bowdoin

By Bowdoin NewsDid you know that gifting appreciated publicly traded securities that you have held for more than a year to Bowdoin can potentially save income tax and capital gains tax?

Before the end of the calendar year, consider making a bigger impact on Bowdoin students and programs by donating gifts of appreciated stocks, bonds, or mutual funds instead of cash.

Learn more about how many Bowdoin supporters choose to make their gifts with appreciated publicly traded securities and potentially save income tax and capital gains tax.

When you sell a long-term stock holding, you trigger federal capital gains tax at rates of 15 percent or more.

By gifting Bowdoin appreciated marketable securities that you have owned for more than one year and a day, you receive an available charitable deduction for the full value of the gift, and neither you nor Bowdoin will have to pay the capital gains tax—a win-win.

A gift of publicly-traded securities could be right for you if:

- You own appreciated publicly-traded securities that you have held for at least one year

- Some of these securities may provide you with little or no income

- You would like to make a gift to Bowdoin College

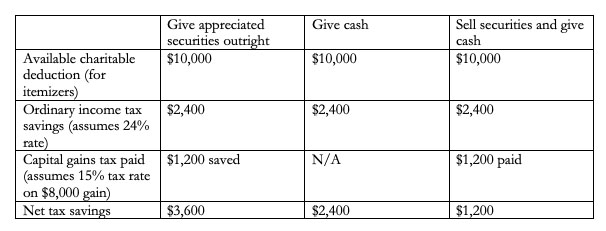

The chart below shows the implications of gifting $10,000 of appreciated securities held for more than one year vs. cash with the following assumptions: appreciated securities with a $2,000 cost basis/$8,000 gain; 24% income tax rate; 15% capital gains tax rate.

Please consult your tax or financial advisor regarding your specific circumstances.

Depository transfer check (DTC) instructions here.

For more information of if you would like to initiate a stock transfer, please contact Joanna Baumgarten at (207)798-7156.

Click here to learn more on the Bowdoin website about the benefits of using appreciated assets to make your gift.