Endowment Return of 10.9 Percent Provides Crucial Support for Student Financial Aid at Bowdoin

By Bowdoin CollegeOf the total endowment distribution in 2018–2019, approximately $31 million supported financial aid. Other distributions restricted by donors were used to support professorships and instruction, lectureships, museums, the library and book purchases, and technology. In the current fiscal year, distributions from the endowment will fund approximately three-quarters of Bowdoin’s $46.2-million financial aid budget.

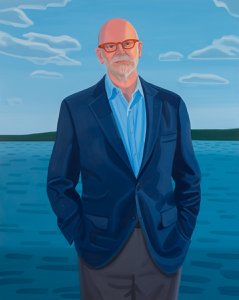

“Our endowment is the crucial factor in our ability to ensure that family finances don’t block access to a Bowdoin education for those students who have earned a spot at the College,” said Bowdoin President Clayton Rose.

“Bowdoin is one of only nineteen colleges and universities in America that provide need-based financial aid without required loans, and that meet a student’s full financial need for all four years. This powerful combination changes lives, but it simply wouldn’t be possible at Bowdoin without the exceptional work of Chief Investment Officer and Senior Vice President for Investments Paula Volent, her talented team, and the expertise and commitment of our Investment Committee.”

Half of Bowdoin’s first-year class receives need-based financial aid, a percentage that is expected to grow. The average grant for all aided students—funds that do not have to be paid back—is approximately $47,000 a year.

The Bowdoin investment return of 10.9 percent compares with the median return of 4.9 percent for all college and university endowments during this period as reported by Cambridge Associates, a firm that tracks the performance of foundations and endowments nationwide.

As of June 30, 2019, the three-, five-, and ten-year annualized returns for Bowdoin’s endowment were 13.0 percent, 10.2 percent, and 12.0 percent, respectively—all in the first percentile among comparative college and university annualized returns, where the respective median returns were 8.8 percent, 5.1 percent, and 8.5 percent.

On June 30, 2019, Bowdoin’s endowment was valued at $1.74 billion. During the 2018–2019 fiscal year, the College transferred approximately $17.8 million in gifts and other additions to the endowment. The endowment provided $67.7 million to the annual operations of the College, and because the actual cost of educating a student at Bowdoin is 36 percent higher than the comprehensive fee, the endowment subsidizes every student, not just those receiving aid.

“The Bowdoin endowment is built on the generosity of generations of Bowdoin alumni, families, and friends, and we take very seriously our responsibility to manage and build these resources for need-based financial aid, for teaching, research, and scholarship, for innovation, and for sustaining excellence in everything we do today and for what we plan to do in the future,” said Rose.

Bowdoin’s endowment consists of more than 1,700 individual funds earmarked for the perpetual support of a variety of College initiatives. The endowment portfolio is diversified across different asset classes, including domestic and international equities, fixed income, private equity, venture capital, real estate, and absolute return strategies. All asset classes are invested through a selection of external investment managers or through market indices. The portfolio is structured with a long-term time horizon, with portfolio diversification and manager selection directed toward protecting endowment capital in challenging investment environments, while growing those assets during periods of economic stability and growth.