Personal Finance 101: New Financial Literacy Club Reaches Out to Alumni

By Rebecca Goldfine

Last summer, Jessica Gluck ’18 received an education in the financial world. Mentored by a wealth manager at Bank of America Merill Lynch, she and a small group of other liberal arts college students learned the ins and out of financial markets, the stock exchange, careers in finance, and other subjects.

At the same time, she was also hostessing at a high-end, farm-to-table restaurant, earning her own money and thinking about the best way to manage it. Following her financially-oriented internship, Gluck realized that other liberal arts students would benefit from training on how to take care of their finances. When she returned to Bowdoin in the fall, she spoke with Nate Hintze, director of Student Activities, and Sherry Mason, an associate director in Career Planning, and both urged her to start a club that exposed students to real-world money issues.

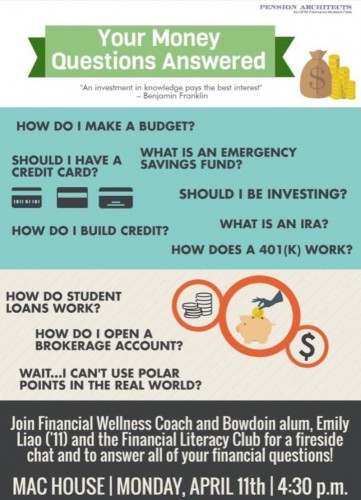

So Gluck, an economics and Hispanic studies major, launched the Financial Literacy Club. It has 65 members on its email list. The group held its first event this April, inviting Emily Liao ’11 to campus to speak about her job as a financial wellness coach. “We want to bring professionals and alumni to campus to host hands-on workshops,” Gluck said. She’s creating a calendar of events for the fall.

Over coffee and cookies in MacMillan House, Liao began her talk by telling the gathered students how to budget after graduation. She described the “50-30-20” rule, which suggests that 50 percent of a person’s income should be spent on essentials (e.g., rent, groceries, transportation), 30 percent on fun and leisure activities (shopping, eating out, travel), and 20 percent on achieving financial goals (saving for retirement). Liao offered ideas for how to keep track of this kind of budgeting, suggesting the mobile phone application Mint as a useful tool.

Over coffee and cookies in MacMillan House, Liao began her talk by telling the gathered students how to budget after graduation. She described the “50-30-20” rule, which suggests that 50 percent of a person’s income should be spent on essentials (e.g., rent, groceries, transportation), 30 percent on fun and leisure activities (shopping, eating out, travel), and 20 percent on achieving financial goals (saving for retirement). Liao offered ideas for how to keep track of this kind of budgeting, suggesting the mobile phone application Mint as a useful tool.

Liao also discussed the importance of knowing how to manage a credit score. She informed students about behaviors that can damage someone’s score, including hard inquires and unpaid or late bills. She also warned students they might need to present a credit score when they apply for apartments.

Liao offered students strategies for starting a retirement fund, discussing various options for investment. She talked about index funds (which appreciate and depreciate along with the market) versus mutual funds (which investors manipulate in order to attempt to generate more returns than index funds), and she discussed the difference between 401(k)s and IRAs. She suggested that young investors should open Roth IRAs to save for retirement.

After Liao finished her presentation, students asked her questions about personal finance, her career, and her time at Bowdoin. She chatted about her experience majoring in English and government, and recalled the acts that performed for the spring Ivies concert weekend during her four years.

Katherine Churchill ’16 contributed to this article