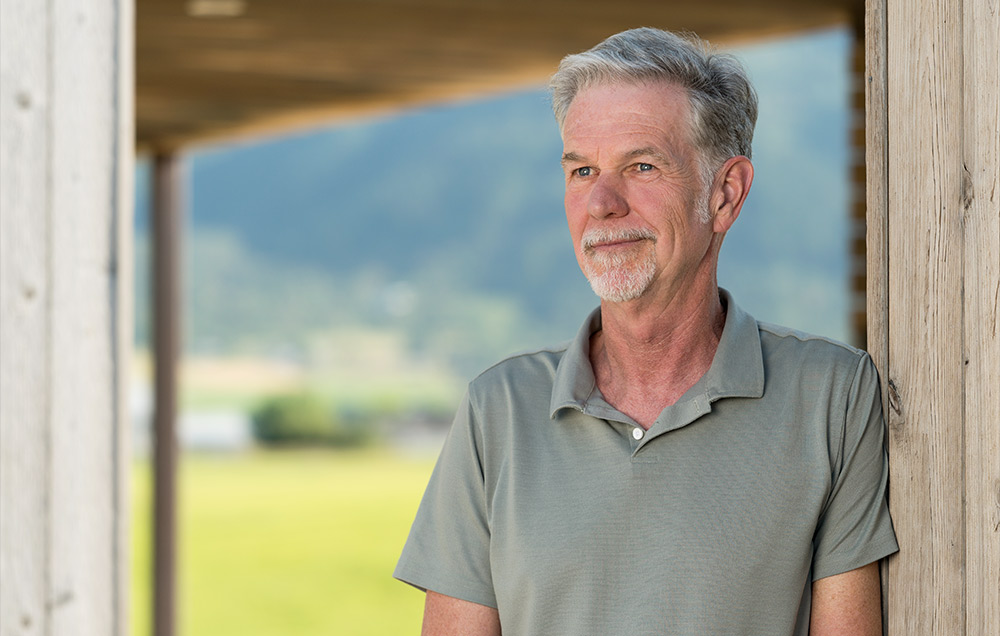

Stephen Morris Analyzes the Interest Rate Hike

By Tom Porter

“If anything,” he says it’s “surprising the hike – or ‘lift off’ as it’s known — didn’t come sooner.” That’s because the Fed’s Open Market Committee, which sets interest rates, “has continually communicated a desire to “normalize” monetary policy over the past several years.

“In fact,” says Morris, “as late as September 2014, the FOMC was communicating that we should see a federal funds rate of approximately 1.4 percent by year-end 2015.”

In the event, of course, the rate hike was much more modest, going from near zero – where it had been for nearly a decade – to a range of between 0.25 and 0.5 percent, or 25 to 50 basis points.

Morris says this scaling back was due in large part to “headwinds from China,” where the world’s second- largest economy suffered a significant slowdown over the summer.

“It’s also interesting to note how the Federal Reserve will implement the rate range,” Morris observes.

“Instead of ‘open market operations,’ as many are used to thinking about through textbook introductions to monetary policy, the Fed will conduct what are known as ‘overnight reverse purchase operations.'”

This, he explains, gives policymakers more control over how they set the floor and ceiling of the new range.

“These operations are necessary, but to most people unfamiliar, implementation tools for monetary policy. They’re vestiges of the dramatic steps the Fed took to fight the Financial Crisis and ensuing Great Recession, including quantitative easing. My students learned about some of these topics in the Unconventional Monetary Policy seminar I offered last spring.”

Impact on the Consumer

With the US economy now judged to be robust enough to withstand a rate hike, albeit a modest one, what will be the effect on the average consumer? Morris says we should expect certain rates, such as those we pay for an auto or credit card, to be affected immediately.

“But the impact on mortgages for example will be more muted.” That’s because mortgage rates have more to do with the long-term outlook, over 30 years typically.

“Since the Fed is signaling the federal funds rate will increase only gradually (about one percent a year for the next three years), we can expect mortgage rates to remain relatively low for some time.”

Where Will the Fed Go From Here?

While the Fed has signaled that it plans to raise rates by approximately one percent annually for the next three years, Morris points out that the “doveish” FOMC has made it clear this is all ‘data dependent.”

“In other words, should we begin to see less tepid inflation, the rate of increase might pick up. But if we face an unexpected downturn, as we saw with respect to China this summer, the opposite is possible.”

Some economists, he says, “currently believe that the so-called ‘equilibrium rate’ of interest is historically low, meaning that rates are likely to stay low for some time, regardless of how healthy the economy seems. But this is a contentious issue,” he adds, “to which there’s no clear consensus.”

As for the Fed’s next move, when the FOMC meets in March 2016, Morris is predicting another 25 basis point hike, with the qualifying caveat “that every piece of incoming data between now and then matters.”