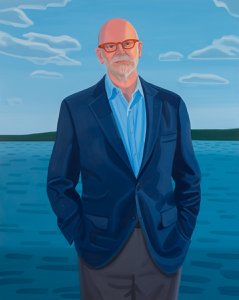

Barry Mills on “No-loans”

This is the first of my postings on the Bowdoin Daily Sun. I expect to write weekly on some subject important to the College or interesting to me, and I invite your comments and thoughts. Although it has been my practice to respond directly to those who contact me, I expect the volume of correspondence to increase as a result of these posts. While I cannot promise a dialogue, we will certainly review your comments and I especially welcome ideas for topics I can address and improvements we can make to the Bowdoin Daily Sun. This is a work in progress, and reader suggestions can help us a great deal.

There has been a lot of publicity recently about the “no-loan” component of financial aid. Williams and Dartmouth have announced that they are reverting to traditional financial aid policies that will require some students on financial aid to borrow. These modifications are obviously the result of the current economic environment and the endowment losses experienced by many during the past year. In a responsible manner, all colleges and universities are looking to reset their expenses to their resources, consistent with their core principles.

At Bowdoin we adopted a “no-loan” financial aid policy just over two years ago, and at the time, we were among the colleges with the smallest endowment to do so. Obviously, the moves by Dartmouth and Williams have gotten my attention. While I have no Bowdoin announcement to make on the issue, it is certainly fair to say that we are constantly reevaluating our programs and policies during these tough economic times. But this “no-loan” program is a concept we should make every effort to maintain because it is good policy and because it makes Bowdoin competitive for the most talented “middle class” students.

At Bowdoin, we teach the need to examine the facts, and on this particular issue, there are several important facts to consider.

The “no-loan” policy at Bowdoin was not generally focused on students and families with the highest need. Many of these students had not been required to take out loans even before our “no-loan” policy went into effect. Nor was the “no-loans” policy ever a prohibition on borrowing.

At Bowdoin, the “no-loan” initiative was designed to help middle class families making between $60,000 and $150,000. These are the families who may be most affected by the recession, who might view Bowdoin as beyond their economic means, and who we frequently support with financial aid. Instead of requiring a loan of roughly $5,000 a year as part of the aid package, Bowdoin simply increased the grant portion of the aid package by roughly that amount. That doesn’t mean people stopped borrowing. In fact, nearly 40% of these folks continue to borrow under federally supported loan programs to cover the parent contribution and other college expenses.

In my view, there is too much focus on whether loans are a good or bad thing for students, with some arguing that students will be more invested in their education if they have debt. Our initiative was never a value judgment on loans (although we certainly did hope to reduce the impact of student debt on job opportunities after college). Rather, it has been a way for us to make Bowdoin more accessible and competitive for qualified students by increasing the grant portion of their aid.

We all know that the cost of college is very high, and families are justifiably looking at their total package and a variety of financing opportunities. In many cases, loans are very much on the table for these families regardless of our policies on financial aid.

The question for us given these economic times is how we take whatever steps are necessary to preserve access to Bowdoin for qualified students regardless of their financial means. This is the essence of our commitment to the common good and should be among our most important priorities.